Airbnb and other short-term rental platforms have exploded in popularity across Central Florida. With millions of visitors heading to Disney, Universal, and other Orlando attractions each year, it’s no surprise that many homeowners and investors are asking: Can you legally operate an Airbnb in Orange County?

The short answer: it depends on the city and zoning rules. Some areas welcome Airbnb, while others strictly prohibit it. Before you buy an investment property or start renting out your home, it’s important to understand the local laws.

What is Airbnb and How Does It Work?

Airbnb is an online platform that connects hosts with travelers looking for accommodations. Unlike hotels, Airbnb rentals often provide full kitchens, living spaces, and the comfort of a home.

Hosts can:

- Rent out their entire home

- Rent individual rooms while still living in the home

- Offer Airbnb Experiences such as tours or activities

- Create Online Experiences, which are interactive classes hosted virtually

For property owners, Airbnb can provide a valuable income stream. But in Central Florida, laws vary from city to city.

Are Airbnbs Allowed in Orange County?

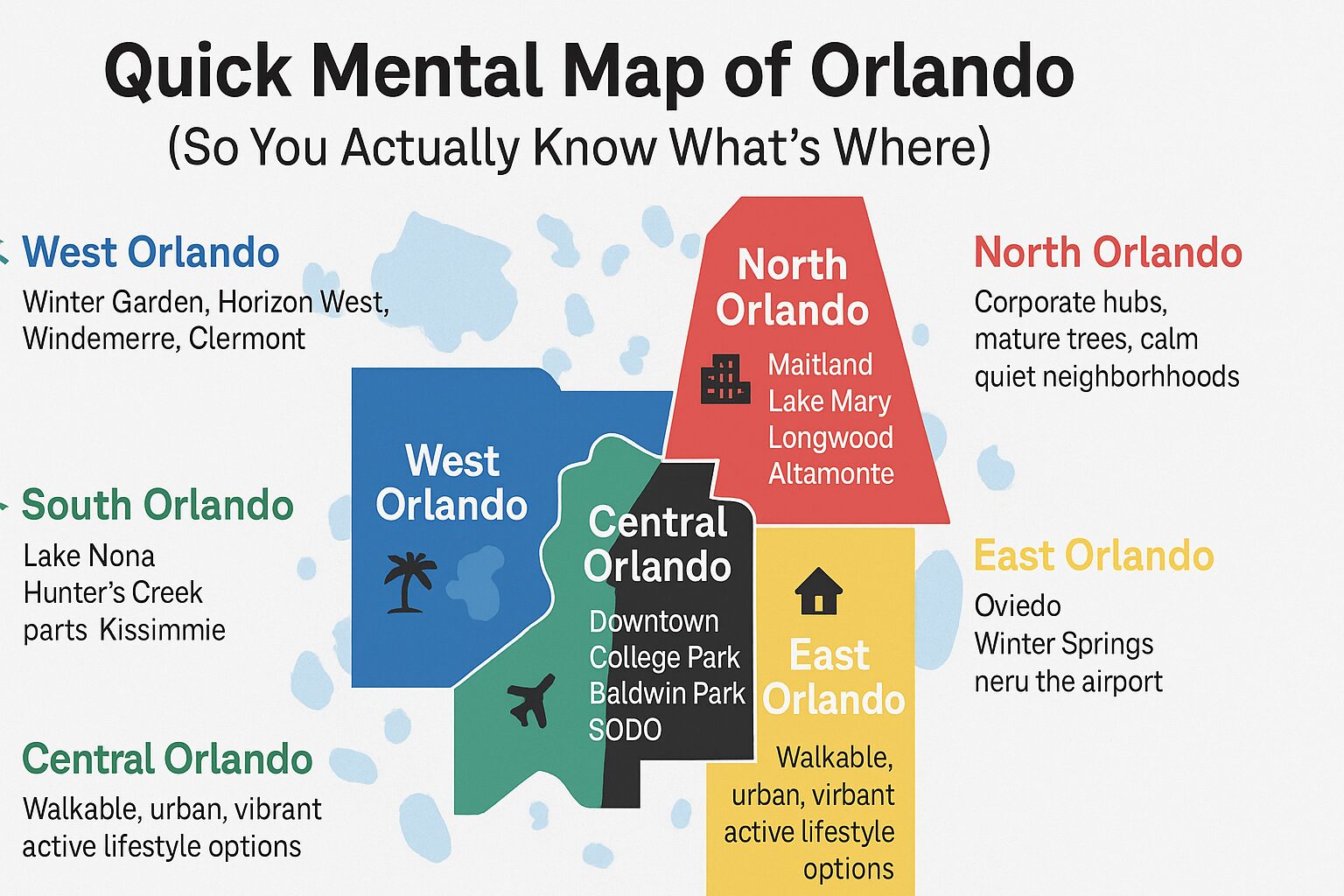

Orange County does allow short-term rentals, but individual cities set their own rules.

- Orlando – Homeowners can rent out part of their primary residence, but strict requirements apply. You must register, pay fees, and follow guidelines such as only renting less than half the house and being present during your guests’ stay.

- Winter Park – Does not allow short-term rentals under 30 days.

- Other cities – Rules vary, and most require registration with the city plus state-level DBPR compliance.

Because of these restrictions, many investors look outside Orange County for Airbnb-friendly options.

Airbnb Rules in Orlando

If you’re considering hosting in Orlando, here’s a quick breakdown of requirements:

- Property must be zoned residential

- Must be your primary residence

- Can only rent out less than half of the home

- Host must be present during guest stays

- Only one booking at a time allowed

- Must register for a short-term rental permit

- Required to collect sales tax through Florida’s Department of Revenue

Pro Tip: Before applying, check with your HOA, landlord, or condo board, since private rules may also prohibit short-term rentals.

Airbnb Rules by City and County

Here’s a quick look at how Airbnb rules differ across Central Florida.

| Location | Allowed? | Key Rules & Restrictions |

|---|---|---|

| Orlando (City) | ✅ Yes, with restrictions | Must be primary residence, rent out less than half the home, host must be present, one booking at a time, short-term rental permit required, sales tax collection required. |

| Winter Park | ❌ No | Short-term rentals under 30 days are prohibited. |

| Orange County (Unincorporated) | ✅ Yes, but limited | Zoning restrictions apply, and hosts must comply with DBPR registration and tax rules. Many neighborhoods and HOAs still restrict. |

| Osceola County | ✅ Yes | Airbnb-friendly, including Kissimmee. Strong demand due to proximity to Disney. Must comply with state DBPR and local business license rules. |

| Polk County | ✅ Yes | Airbnb zoning permitted. Lower home prices make it attractive for investors. Must follow state registration and tax collection requirements. |

This makes it clear where opportunities exist for investors looking to maximize their returns.

Neighboring Counties Where Airbnb is Allowed

If your heart is set on owning an Airbnb in Central Florida, consider nearby counties that are far more lenient.

Osceola County

- Cities like Kissimmee are hot spots for Airbnb

- Just minutes from Disney and major attractions

- Strong demand from tourists looking for affordable vacation rentals

Polk County

- Slightly farther from the theme parks, but still a short drive

- Lower property prices make it attractive for investors

- Airbnb zoning is permitted, opening more opportunities for hosts

Apart-Hotels in Orlando

Another growing trend is the rise of apart-hotels. Some apartment complexes partner with property management companies to lease units specifically for Airbnb. In Orlando, a few complexes near the airport, downtown, and Mall at Millenia have already received approval.

Taxes & Regulations to Know

Operating an Airbnb in Orange County comes with tax and legal responsibilities:

- Tourist Development Tax, charged on short-term stays in Orange County

- Sales Tax, required on all transient accommodations

- DBPR Registration, full properties must be registered with Florida’s Department of Business and Professional Regulation

- City Business License, Orlando requires a business tax receipt

- Other Rules, HOA restrictions, condo board bylaws, and lease agreements may also apply

Should You Invest in an Airbnb in Central Florida?

With millions of annual visitors, there’s no doubt that demand for short-term rentals is strong. But navigating the patchwork of zoning rules can be tricky.

Pros of owning an Airbnb here:

- High tourist demand

- Strong potential for income

- Proximity to Disney, Universal, and Orlando attractions

Cons:

- Strict rules in Orange County cities

- Extra tax and permit requirements

- HOA and neighborhood restrictions

For many investors, nearby Osceola or Polk County offers a simpler path to running a profitable Airbnb.

Work With Local Experts

Purchasing property for Airbnb use can be rewarding, but only if you fully understand the legal landscape. That’s where The Erica Diaz Team comes in.

We’re local real estate experts with over 715 five-star reviews, named a Zillow Premier Agent and recognized by the Orlando Business Journal. Whether you’re looking to buy a vacation rental near Disney or sell your home in Orlando, we can guide you through the process with confidence.

Call us today at 407-904-2702 or reach out through our contact form to discuss your investment goals.

Final Thoughts

Airbnb in Orange County isn’t as simple as listing your home online. Laws vary by city, and failure to comply could cost you. But with the right property and guidance, you can still tap into the booming short-term rental market in Central Florida.

Thinking about investing in an Airbnb? Contact The Erica Diaz Team today and we’ll help you find the right property in the right location.