FHA Loans vs Conventional Loans! What’s Best for You?

Buying a home in cash may seem ideal, however, it is not the most common method. Luckily, when you’re ready to buy a house, there are multiple funding options to make it happen. Two of the most commonly used funding options are FHA loans and conventional loans.

For most homebuyers, taking out a mortgage is part of the home buying process. But with so many mortgage loan options to choose from, how do you know which one is best for your specific situation? In this article, the Erica Diaz Team breaks down the details of the two most popular mortgage loan options. These loan options are FHA loans and conventional loans.

This article on FHA loans and conventional loans will help you determine which funding option is the best fit for you. Whether, you determine the best loan for your home buying needs, or still have questions, contact the Erica Diaz Team. Our knowledgeable team of real estate agents are ready to help you choose a loan option and find the perfect home for you!

FHA Loans

FHA (Federal Housing Administration) loans are typically the go-to loans for first-time homebuyers. A key thing to remember about FHA loans is that it is NOT a loan from the government. It IS a loan by FHA-approved lenders that is insured by the Federal Housing Administration.

FHA loans are appealing to new homebuyers because the down payment required is generally lower than that of a conventional loan. This makes it easier and more affordable for most first-time homebuyers to jumpstart the process.

FHA Loan Requirements

While the FHA Loan program was created to help more people buy homes, it DOES have requirements.

- FICO® score of at least 580 will require a 3.5% down payment.

- FICO® score between 500 and 579 will require a 10% down payment.

- Mortgage Insurance Premium (MIP) is required.

- The debt-to-Income Ratio CANNOT be more than 43%.

- The home purchased must be the borrower’s primary residency.

- Proof of income and steady income are required by the borrower.

What is a FICO® Score?

FICO® is a company that uses data analytics to compile the results of a consumer’s credit history and ultimately scores it. Your FICO® score tells a mortgage lender what your creditworthiness is.

Lenders review FICO® scores to determine a potential buyer’s likelihood of making payments. The higher the score the better chance of a lower interest rate. This is because higher scores show that the buyer can not only afford the payments but will make them in a timely manner.

FHA Loan Benefits

Lower Credit Standards

New homebuyers don’t always have a rock-solid credit history. Luckily, this does NOT hold them back from qualifying for an FHA loan. Borrowers with a score as low as 500 can still qualify for this type of loan. FHA loans are also used by people who have faced bankruptcy or foreclosure. They are still able to qualify for an FHA loan.

Assumable Loans

An FHA loan is assumable, which means that if you were to sell your home, the new buyer can take over your loan, or assume responsibility for the payments. This is a really cool aspect of this type of loan.

Larger Income to Debt Ratio

Before qualifying you for an FHA loan, lenders will want to see the ratio of income to the debt you have. If you were applying for a conventional loan, you’d be denied if your total monthly debt payments plus the potential new monthly mortgage payments exceed 36% of what you made a month. FHA loans are different, in that the cap for the income to debt ratio is anywhere between 43-50%, giving homebuyers more wiggle room in their finances.

Small Reserve Funds

Lenders will want to peek into your bank account to see how much cash you have “reserved” to ensure you have the money to pay bills once the loan is approved. For an FHA loan, the buyer is only required to have one month’s worth of funds in the bank, making it easier to qualify without a lot of cash in the bank.

Help with Closing Costs

Closing costs can often throw new homebuyers for a loop. They can add a significant amount to what is owed on the home. While most sellers step up to help with the costs, conventional loans only allow them to contribute 3%. With an FHA loan, it increases to 6%. This can help tremendously in covering closing costs.

Downpayment Help

It’s common for those who are applying for an FHA loan to need a little help with the downpayment of a home. This can honestly fall under both benefits and drawbacks. However, we believe it’s more of a benefit as long as it’s done correctly.

While FHA loans do allow for the buyers to be gifted funds for a downpayment, there are regulations. There are rules about how the funds are sourced and who is able to provide this type of gift. As long as supporting documentation is provided funds are able to be gifted from:

- Family members of the borrower.

- An employer or labor union of the borrower.

- A close friend as long as proof can be provided of the significance of the relationship.

- Charitable organizations.

- A government agency or public entity. A program providing homeownership assistance to low- or moderate-income families or first-time homebuyers. Coming from a government agency or a public entity.

FHA Loan Drawbacks

Of course, FHA loans do have their drawbacks too.

Mortgage Insurance Structure

The most significant disadvantage for the FHA loan is that the mortgage insurance structure requires both an upfront and monthly premium. The premium is calculated on any portion of your mortgage that is over 80% of a buyer’s new home value.

It’s important to remember the FHA loan is not a government loan. It is a loan that has mortgage insurance provided by the FHA (Federal Housing Association). The loan itself is given from FHA-approved lenders.

Minimum Property Standards

Since the FHA is a government-backed loan, there are specific guidelines about the types of properties you can buy. This sometimes means a fixer-upper won’t qualify for this type of loan.

Loan Limits

The loan limits of an FHA are much lower than other loans. Meaning it makes the most sense to buy property in low-cost areas. This could decrease the property options for homebuyers based on location.

Conventional Loans

One popular aspect of the conventional loan is that the mortgage insurance can be canceled once the home equity hits 20%. Homebuyers often find that conventional loans are more flexible than FHA loans. Another selling point for conventional loans is that they do NOT have to be applied towards a buyer’s primary residence. They are not specific for any one type of buyer. This is an excellent option for a buyer with a strong credit history and a good chunk of change to put down upfront.

One popular aspect of the conventional loan is that the mortgage insurance can be canceled once the home equity hits 20%. Homebuyers often find that conventional loans are more flexible than FHA loans. Another selling point for conventional loans is that they do NOT have to be applied towards a buyer’s primary residence. They are not specific for any one type of buyer. This is an excellent option for a buyer with a strong credit history and a good chunk of change to put down upfront.

Conventional Loan Benefits

Lower Cost Mortgage Insurance

Like the FHA, conventional loans DO require mortgage insurance to protect the lender. However, it’s typically much lower than an FHA loan. And the mortgage insurance does not apply to mortgages with LTV ratios under 80%.

More Flexibility in Property Types

Because the conventional loan is not a government-insured loan, it allows more flexibility in the types of property that can be bought. If you qualify for the loan and can come up with the required downpayment you can use it towards any home you’d like.

Credit Sensitive

With an FHA loan, it’s a one-size-fits-all premium regardless of credit history. While this is great for those with a rocky credit score, it doesn’t do much for those who have a great rating. With a conventional loan, the premium is based on your credit, so a good score means a lower premium.

Lower Monthly Payments

The natural result of a higher down payment is lower monthly payments. This is a great benefit for ALL homebuyers!

Conventional Loan Downfalls

Conventional loans are best for home buyers with a strong credit score and who are financially stable, but they do have a few drawbacks:

Requires Higher Down Payments

This isn’t necessarily a negative for everyone, as some buyers don’t mind the higher upfront down payments to reap the other rewards of the loan. However, the bigger down payment can make it tough for those tight on cash to qualify.

Require Higher Credit Score

There’s a reason so many first-time homebuyers start with an FHA, as it offers flexibility for those still working on their credit. Conventional loans are stricter on the credit requirements and can be an obstacle for those with less than perfect credit to qualify.

Closing Costs

With a conventional loan, closing costs can’t be included in the mortgage payment like it can with an FHA. This is another example of how conventional loans work better for people who have a more substantial cash reserve on hand, allowing them to cover the closing costs upon settlement.

So What is Better? A Conventional Loan or an FHA Loan?

The answer is… It ultimately comes down to your credit and financial situation. Both loans are good options when being used based on your personal situation. The type of property you are looking to purchase will also play a part in which loan is the best fit for you.

Erica Diaz Team – FHA Loans vs Conventional Loans! What’s Best for You?

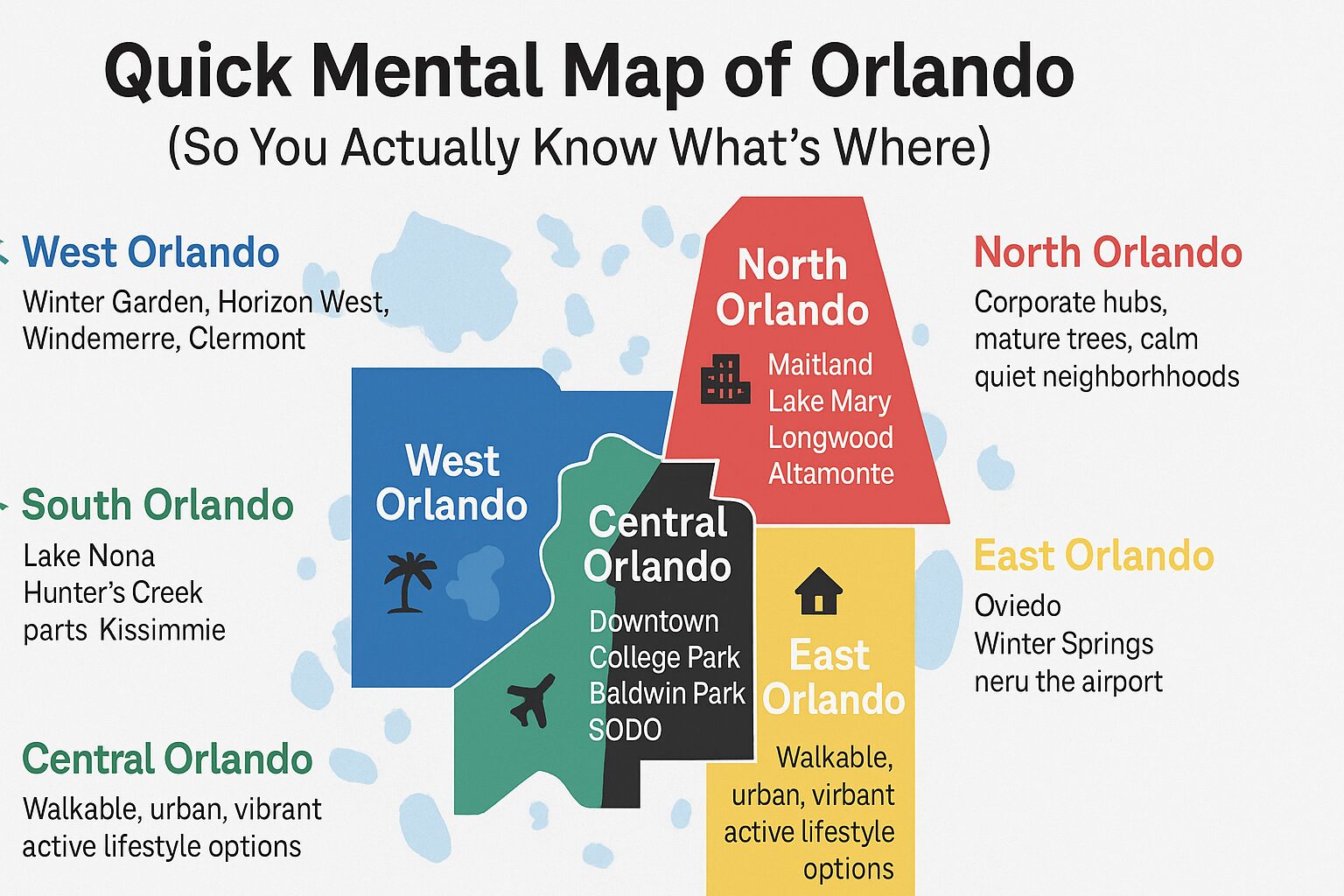

As Central Florida and the surrounding area’s premier real estate team, the Erica Diaz Team understands loans. Unless you’re paying cash for your next home, understanding the difference in loan options is critical. If you’re drawing a blank on how to even get started, contact Erica Diaz and her team today. They can help you to understand the difference between FHA loans and conventional loans. Then, once determined what your best loan option is, they will help find your dream home!

Whether you’re looking to buy or sell, our connections, real-estate insight, and access to off-market properties make the Erica Diaz Team your Central Florida real estate agents of choice. The Erica Diaz Team offers clients a full range of services from home purchasing, property listing services, and even property management!

Contact us today to discover your perfect Central Florida home today!