7 Mortgage Myths Debunked

Buying your first home can be a stressful event. After all, it is probably one of the most significant decisions you will make in your lifetime. Friends and family always offer plenty of tips to help make this decision easier. However, when it comes to debunking mortgage myths, leave the facts to us (Erica Diaz Team)!

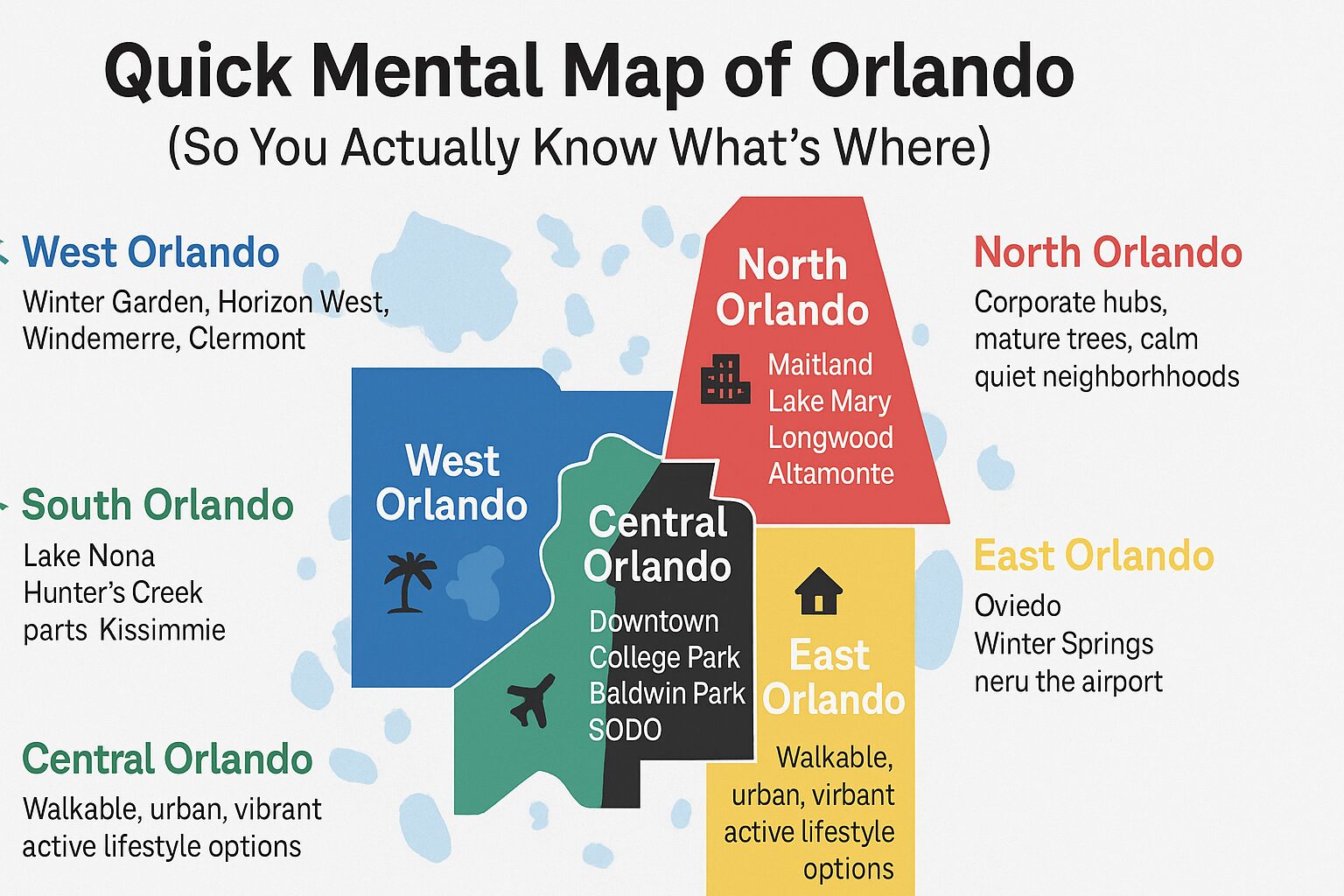

We have compiled a list of the top mortgage myths to help steer you in the right direction when buying a home. We are Central Florida’s premier real estate team and here to make your home buying process an enjoyable one!

Mortgage Myths

There are dozens of mortgage myths out there! As a home buyer it is imperative you ignore the chatter and go straight to the source for home buying facts. As a team of knowledgeable and local Central Florida real estate agents, the Erica Diaz Team can guide you from start to finish in the home buying process.

In this article, we are debunking some of the most popular (but very wrong) mortgage myths.

#1. Find a home first, then get approved financing.

You found your perfect home! Only to be disappointed when you don’t qualify for financing. THIS is precisely why it is crucial to consult with a lender before finding your dream home. A lender will ask you questions and check your credit to get pre-approval. This will also give you a good idea of the price range to secure a reasonable interest rate, saving you money in the long run.

Contact us, and we will connect you with our trusted lender to start the pre-approval process today!

#2. You must have perfect credit.

Do not think you have to have perfect credit to qualify for a home buyer loan. If you have a steady income and pay your bills on time, you can qualify for a loan. Conventional loans typically require a score of 620, and FHA loans require as low as 500. Factors such as down payment and current income will also play a factor in the amount of loan you can receive.

#3 You will need to put down 20%.

Many first-time homebuyers think they need to put down 20%, but this is not the case. According to the Zillow Group Consumer Trends Report, only one-quarter of buyers (24 percent) pay 20 percent of their home’s purchase price upfront as a down payment. Many different programs offer even lower down payments. Freddie Mac and Fannie Mae offer programs with 3% and 3.5% with FHA. If you qualify for USDA and VA programs, they can require no down payment at all.

The national average down payment is 12% as of 2020 and as low as 7% for first-time home buyers. So don’t let the 20% down mortgage myth scare you away from buying your first house.

A knowledgeable real estate agent can help you from beginning to end in the home buying process. Contact the Erica Diaz Team now, and we can help determine what loan is best for you!

#4. It’s best to get a 30-year fixed-rate mortgage.

Although it is a popular choice, there are many options out there. If you only plan on living in a particular area for a short time, a short-term solution with a lower rate may be a better option. There are also perk to choosing a 15-year mortgage as well!

#5. You can’t use gifts or grants for your down payment.

Most mortgage companies do allow down payments to come from any source as long as the sources are documented. Often, first-time homebuyers are given gifts from parents or friends to use as a down payment on a house.

In addition to gifts, there are also grants available from non-profits or other sources such as company-sponsored home-buying programs. You can find more information on down payment assistant programs when you connect with a real estate agent.

#6. You must use the lender that pre-approved you.

As previously mentioned, there are many different options for choosing a lender. While getting pre-approved may be your first step in the home buying process, you have many options to consider.

When considering a lender, it is in your best interest to shop around and compare terms. You could end up saving tens of thousands of dollars over the years on the term of your mortgage. In addition to your bank or credit union, you can find local lenders on Zillow to provide estimates.

If you would like someone else to handle the searching, contact the Erica Diaz Team, and we will help you source the best lender for you!

#7. If you’re denied once, you will never be able to get a mortgage.

Even though you may have had financial difficulties in the past, it does not mean you can never qualify for a mortgage. Although lenders do look at credit history, they also acknowledge improvements made. Knowing the loan requirements and having a plan of how to get there are most important.

Erica Diaz Team – 7 Mortgage Myths Debunked

Now that we have debunked the common mortgage myths, you are ready to begin your journey to homeownership. As always, we hope you will consider the Erica Diaz Team when you are ready to start looking for your dream home.

If you’re ready to begin the home buying process in Central Florida, contact us today! You can also learn more about buying in Central Florida here.