The Entrepreneur’s Guide to Owning a Home

As an entrepreneur, you most likely own your own business… Don’t you think it’s time you own your own home too!? In this guide, we explain the ins and outs of being an entrepreneur with a dream of owning your own home. The home buying process is going to be a little more challenging than it is for a typical W-2 paid employee. This is due to successfully proving your income. It is going to require more paperwork. The good news is…being an entrepreneur will NOT stop you from getting a mortgage! With that in mind, what’s a little extra paper work for you to buy a home?

Lenders will need to see more than just your personal tax return due to the fact you are an entrepreneur. This is necessary due to the fact there is more of a financial burden on entrepreneurs. The process of getting a mortgage to buy a home is going to require proof of income from your business as well.

The Erica Diaz Team Welcomes Entrepreneurs to the Home Buying Process!

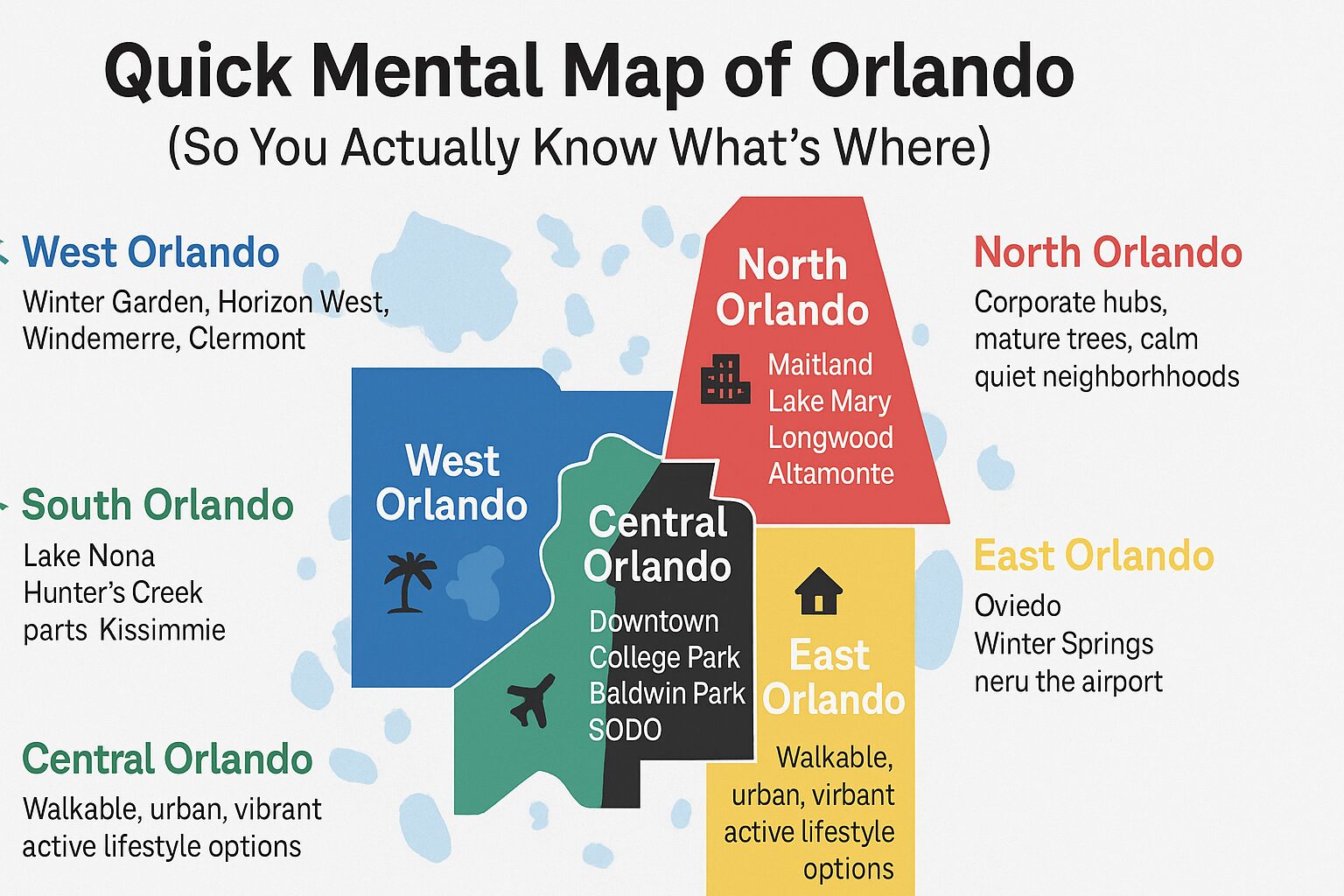

At the Erica Diaz Team we pride ourselves in being local real estate experts in our community. We help home buyers ever day find and fall in love with their dream home in Winter Garden, Clermont, Windermere and other surrounding areas. Our team understands that not all homebuyers are the same.

As an entrepreneur we want to help you finally own your first home. The process may require a little more effort on everyones behalf, but we are up for the challenge if you are! To get you as an entrepreneur started off on the right foot of the home buying process. We wrote this article packed with helpful info about owning a home as an entrepreneur!

Can I Get a Mortgage as an Entrepreneur?

Yes! However, it may not be as easy as getting a conventional mortgage, it IS absolutely doable. A major point to focus on is your record keeping. It will play a vital part in receiving a mortgage as an entrepreneur. This process can be more seamless if you consistently declare your income accurately. If your tax documents are NOT in good shape, more than likely a bank will not give you a mortgage. Make sure to keep great records of your personal and business accounts to accurately show your income. Also, keep them SEPARATE!

Since having to prove your income can be more challenging as an entrepreneur, we suggest you schedule a meeting with your banker personally to assist and guide you in organizing your records. This can greatly improve your chances as well. It never hurts to build a rapport with them. Because it’s harder for entrepreneurs to show stable income versus employees who receive a W-2, it’s important to have everything organized for not only your taxes, but with the intention of getting a mortgage.

Keeping all the numbers straight and organized can be challenging. After all, you are an entrepreneur, not an accountant right?! With that said, if you have intentions of purchasing a home, then now is a good time to hire an accountant. They are great at organizing this kind of stuff. Also, tell them from the beginning that you intend to buy a home in the near future.

Qualifying for a Mortgage as an Entrepreneur

Qualifying for a Mortgage as an Entrepreneur

As an entrepreneur you’re going to need to show documentation in order to secure a mortgage from a lender. Here are some key pieces you will need:

- Verification for Mortgage – You need to show at least two years of both your business and personal tax returns, along with any other documentation of income that may be required by a lender to confirm your income.

- Proof of Your Assets and Liability – Even though you need to show both, DO keep your business and personal accounts separate. This will make the process of proving your personal assets over your business assets easier. You’ll need to include retirement accounts and any other financial accounts or investments you may have. It’s also IMPERATIVE to disclose any liabilities such as alimony or child support to give an accurate look into your finances.

- Up to Date Tax Records – ALL IRS tax payments need to be up to date to ensure a seamless approval. If you owe the IRS money, make sure it is paid before you apply for a mortgage.

What are the Requirements to Qualify for a Mortgage as an Entrepreneur?

The MAJOR requirement for an entrepreneur, is they need to be in business for at least two years before applying for a mortgage. There are some new mortgages that will do certain cases as early as one year depending on financial factors and financing needed. For instance there is a large down payment and only a small mortgage is needed. The financial risk is much lower to a bank than someone who has very little to put down and requires a higher loan amount. So, if you do not have a hefty down payment, it’s in your best interest to wait at minimum 2 years before applying for a mortgage. This will show consistent income and that the business is successful. The bigger the down payment and the longer the business has been open, the better the chances will be of securing a mortgage.

What is the Process to Receive a Mortgage as an Entrepreneur?

Surprisingly, the process of an entrepreneur is actually the same as a W-2 employee. The difference lies in the proof of income. You need to provide a corporate tax return. This return will play a key role in a mortgage application as an entrepreneur. Another thing to keep in mind is anyone who owns a quarter of their voting stock or more is also considered a business owner. It’s important to know what percentage you own in your company if it’s not one hundred percent. The goal of this process is to find your debt to income ration. Depending on the outcome, lenders may or may not approve you as a qualified candidate. An underwriter is looking to see how your business is doing and whether or not it is thriving.

How Much are You Writing Off?

As an entrepreneur an awesome perk is the capability of writing off numerous deductions. However, if you’d like to buy a house, it is a good idea to limit what you’re deducting. This will allow you to show a higher income. Having too many deductions may result in you showing a lower income. Unfortunately, this will also lower your chances of getting a mortgage. The bank will see this as you don’t earn enough money from your business.

How is Your Credit?

Being an entrepreneur does not make it any less important to maintain good credit. Your credit score is imperative in getting yourself a good interest rate once you secure a mortgage loan. It is heavily evaluated on payment history and the utilization of your overall credit so make sure you’re paying attention to your debt! A few points difference can mean thousands of dollars in interest, so make sure you’re up to date on your bills both in your business and personally. Also, check your credit score to ensure there are no discrepancies, as it can take weeks to months to fix after filing one.

Key Points to Buying a Home as an Entrepreneur

Buying your own home is a big step and exciting time! Make sure you are saving up and paying down your debt to increase your chances of a great interest rate. The more years of income you can show, the better your chances of securing a loan for your mortgage. Start building your wealth team, if you don’t already have one. Accountants, brokers, financial planners or advisors, and a real estate team are great people to have at your disposal and in your corner to help you through this process.

- YES, you can get approved for a mortgage as an entrepreneur!

- As an entrepreneur you’re going to need to show documentation in order to secure a mortgage from a lender.

- at least two years of both your business and personal tax returns, along with any other documentation of income that may be required by a lender to confirm your income.

- Proof of Your Assets and Liability.

- Up to Date Tax Records.

- You’ll need to be in business for at least two years before applying for a mortgage. (There are occasional exceptions.)

- The process of an entrepreneur is actually the same as a W-2 employee. The difference lies in the proof of income. You need to provide a corporate tax return.

- Don’t write off to much in your business, you’ll need to have a decent amount of income to show.

- The better credit score you have the lower the interest rate you’ll get!

Erica Diaz Team – The Entrepreneur’s Guide to Owning a Home

As an entrepreneur, have you been told you can’t own a home because no-one will approve you for a mortgage loan? Luckily this is not true! You can absolutely buy a home even if your only income is as an entrepreneur. The mortgage approval process is a little more tedious, requiring more paperwork and proof of income, but it is doable. The Erica Diaz Team is ready and available to help you every step of the way!

If you’re an entrepreneur and ready to call Winter Garden, Windermere, Clermont, or a surrounding area home, contact us today! You can also learn more about buying in the area here.