How Your Mortgage Interest Rate Affects Winter Garden Real Estate Sales

Are you ready to geek out over interest rates and real estate? We didn’t think so! We realized buyers, sellers and investors often overlooked the effect of historical interest rates on the Winter Garden real estate market.. This article will explore the fascinating world of interest rates and their evolution throughout history. But don’t worry; we won’t put you to sleep with boring financial jargon. We’ll explain everything in a way that even your grandma could understand. We’ve covered you from the early days of interest rates to the latest trends in Winter Garden real estate sales. So, get ready to learn why interest rates are more than just numbers on a screen.

The Early Days of Interest Rates

The history of interest rates is a fascinating tale of economics, politics, and human nature. Believe it or not, people have charged interest on loans for thousands of years. The earliest recorded evidence of interest rates dates back to ancient Babylon in 2000 BC.

Over time, the concept of interest rates evolved and became intertwined with government policies and financial regulations. Today, interest rates play a critical role in the global economy and significantly impact everything from the price of goods and services to the value of real estate.

From the creation of the Federal Reserve System in 1913 to the 2008 financial crisis, numerous events have affected interest rates throughout history. And as economic cycles ebb and flow, interest rates continue to fluctuate, influencing the decisions of investors, entrepreneurs, and consumers’ decisions.

The Impact of the Fed on Mortgage Rates

If you’re searching for a new home, you are likely aware that mortgage rates are crucial in impacting your choices. But did you know that the Federal Reserve interest rates significantly impact mortgage rates?

When the Federal Reserve adjusts its target interest rate, it can cause a ripple effect that impacts mortgage rates.

So why does this happen? Essentially, banks and lenders borrow money from the Federal Reserve, and the target interest rate influences the interest rate they pay. When the target rate goes up, borrowing costs increase, which can lead to higher mortgage rates.

On the other hand, when the target rate goes down, borrowing costs decrease, which can result in lower mortgage rates. This is why it’s essential to keep an eye on interest rate trends if you plan to buy a home.

How Fluctuations in Interest Rates Affect Buying Power

If you like to keep tabs on the latest economic trends, you’re probably already aware that interest rates profoundly impact buying power. But what exactly does that mean?

When interest rates increase, the borrowing cost increases, meaning lenders can charge more for loans. This, in turn, can lead to higher monthly payments for things like mortgages, car loans, and credit cards, reducing your buying power.

Conversely, when interest rates decrease, the expense of borrowing money reduces, allowing lenders to propose more affordable interest rates and more advantageous conditions. This can lead to lower monthly payments and increased buying power.

So, why does this matter? Because buying power is your purchasing power, it can determine whether you can afford a new home, car, or another big-ticket item.

Interest Rates & Real Estate Market Trends

If you follow the real estate market, you might have noticed that interest rates and trends seem connected. But what exactly is the correlation between these two things?

Interest rates can significantly impact the real estate market, influencing everything from home sales to property values. When interest rates are low, buyers may have more purchasing power, leading to increased demand and higher prices.

When interest rates are elevated, purchasers may have a reduced inclination to apply for loans, resulting in a decline in demand and decreased prices. Additionally, interest rates can impact the overall economy and the real estate market. For example, interest rates may be lowered during a recession to stimulate economic activity, leading to increased home sales.

The Impact on Housing Affordability

Home purchasing is the most significant investment that many individuals will ever undertake. And regarding affordability, interest rates can play a crucial role. When interest rates are low, buyers may be able to afford larger mortgages, increasing their purchasing power and making it easier to buy a home.

Conversely, when high-interest rates, buyers may be forced to settle for smaller mortgages, making it more challenging to find a suitable home within their budget.

But interest rates can also impact the overall cost of homeownership beyond just the mortgage payment. For example, when interest rates are low, homeowners can refinance their mortgages at a lower rate, reducing their monthly payments and overall expenses. Additionally, low-interest rates can make financing home improvements or other upgrades more affordable.

Interest Rates and Winter Garden Real Estate Sales

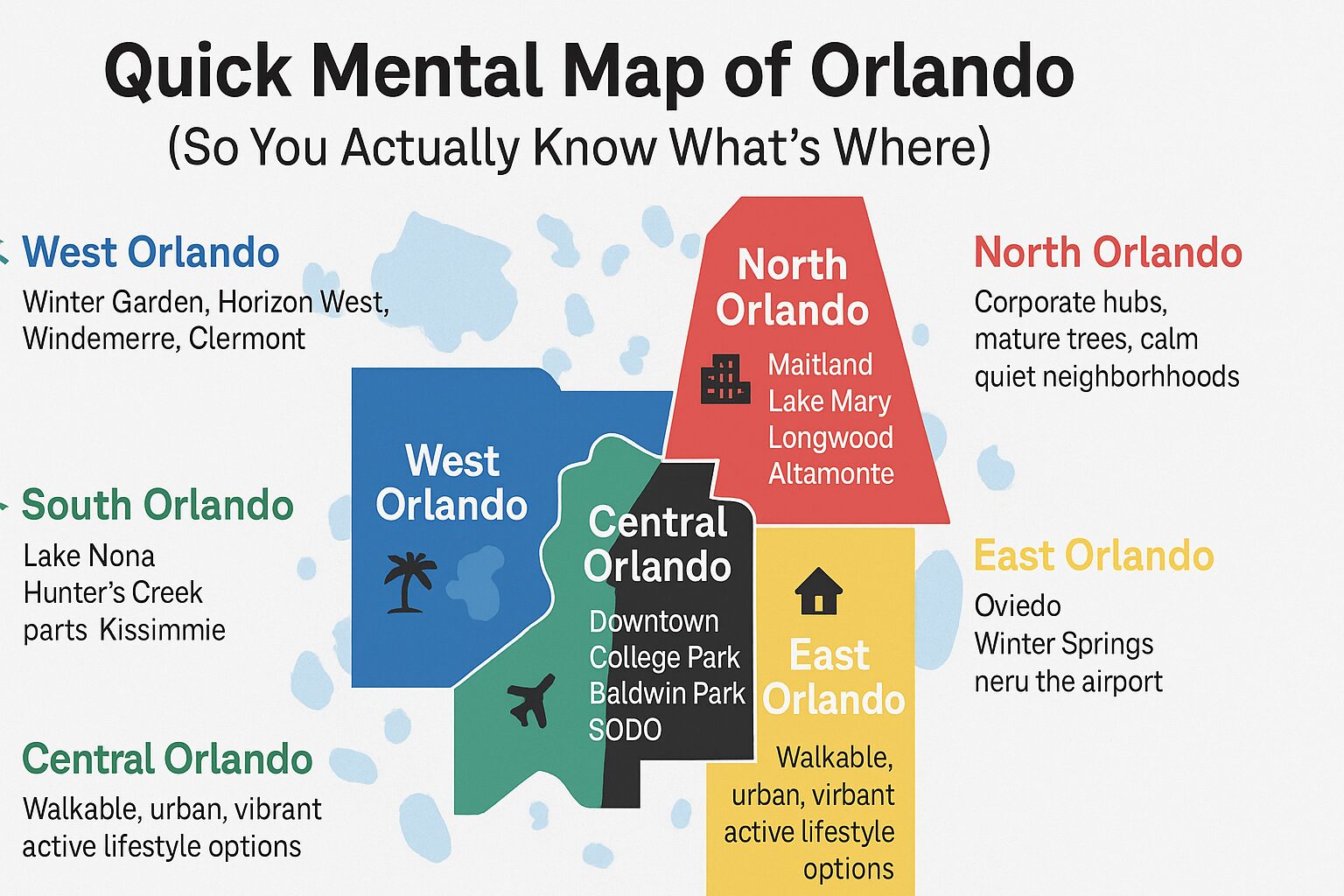

Winter Garden is a charming city in central Florida that has seen a surge in real estate activity in recent years.

With its picturesque downtown area, family-friendly neighborhoods, and proximity to major theme parks and attractions, it’s no wonder that Winter Garden has become a popular destination for homebuyers and investors alike.

But how do interest rates impact the Winter Garden real estate market? For starters, interest rates can influence the affordability of homes in the area.

When interest rates are low, buyers may be able to afford larger mortgages, leading to increased demand and higher home prices. Conversely, when interest rates are high, buyers may be less likely to take out loans, leading to decreased demand and lower home prices.

Looking back at Winter Garden’s real estate history, interest rates have played a significant role in market trends. For example, during the 2008 financial crisis, interest rates dropped to historic lows, which helped stimulate the local real estate market and increased sales activity. However, as interest rates rose in subsequent years, the market slowed, and prices became less favorable for buyers.

Currently, interest rates remain historically low, contributing to a highly competitive real estate market in Winter Garden. Despite the challenges posed by low inventory and high demand, the city attracts buyers and investors eager to capitalize on the area’s growth potential.

Many experts predict that interest rates will remain relatively stable in the coming years, which could bode well for Winter Garden’s real estate market. With the right mix of affordability, amenities, and location, Winter Garden is poised to remain a top destination for homebuyers and investors looking for a slice of Florida’s vibrant and exciting real estate market.

Winter Garden Real Estate Strategies

Whether you’re a first-time homebuyer, a seasoned seller, or an experienced investor, navigating the Winter Garden real estate market can be challenging. With interest rates fluctuating and market conditions changing rapidly, it’s essential to have a solid strategy in place to achieve your goals.

For buyers, low-interest rate environments can be an excellent opportunity to lock in favorable mortgage rates and maximize buying power. Some strategies for buyers in Winter Garden may include exploring pre-approval options, being flexible with home search criteria, and working with a knowledgeable real estate agent who can help identify properties that meet their needs and budget.

On the other hand, sellers in Winter Garden may need to adjust their strategy during high-interest rate environments. Buyers may be more price-sensitive when high-interest rates and homes may take longer to sell. Some strategies for sellers in Winter Garden may include pricing their home competitively, making necessary repairs and upgrades, and staging their home to appeal to a wide range of buyers.

For investors, fluctuating interest rates can provide unique opportunities to take advantage of market conditions and maximize returns. Investors may focus on cash-flowing rental properties or short-term fix-and-flip projects with low-interest rates. In contrast, during high-interest rates, investors may shift their focus to longer-term investments or alternative financing options, such as private money lending.

Ultimately, the key to success in the Winter Garden real estate market is to stay informed, be flexible, and work with a team of experienced professionals who can help you navigate the market and achieve your goals. Buyers, sellers, and investors can position themselves for success in this dynamic and exciting real estate market by understanding the unique opportunities and challenges presented by interest rates and market conditions.

The Reach of Interest Rates

Ultimately, interest rates are vital in the real estate market, influencing everything from mortgage rates to property values. As we’ve seen, the Winter Garden real estate market is no exception to this rule. Interest rates have historically influenced the market trends and buying power in Winter Garden, impacting the decisions of buyers, sellers, and investors decisions. It’s crucial to remain knowledgeable about present interest rate patterns and market circumstances to capitalize on the opportunities provided by the Winter Garden real estate market.

For buyers, sellers, and investors, working with an experienced real estate team can make all the difference in achieving your goals and making sound financial decisions. At the Erica Diaz Team, we specialize in helping clients navigate the Winter Garden real estate market, providing expert guidance and personalized service every step of the way. Whether you’re a first-time homebuyer, a seasoned investor, or a seller looking to maximize your return, we’re here to help. So, if you’re ready to take advantage of the opportunities presented by the Winter Garden real estate market, call us today at 407.951.9742.

Let’s work together to achieve your real estate goals and secure your future in this vibrant and exciting market.