Purchasing a short-term rental property in Central Florida can be a lucrative investment. With millions of tourists flocking to the area for theme parks, sunshine, and the vibrant local culture, it’s a prime location for those interested in generating extra income through vacation rentals. But before you dive into the market, it’s essential to be aware of the regulations, HOA restrictions, and best practices to ensure your investment flourishes. In this guide, we’ll break down everything you need to know about buying short-term rental properties in Central Florida, including key insights into laws, Homeowner Associations (HOAs), and the investment potential of this dynamic market.

1. Understanding the Central Florida Short-Term Rental Market

Central Florida is home to some of the most visited tourist attractions in the world, including Walt Disney World, Universal Studios, and a wealth of natural beauty. This makes it a highly attractive area for short-term rental investments. Many travelers prefer the comfort of a home over traditional hotels, which opens opportunities for investors looking to buy properties specifically for short-term rental purposes.

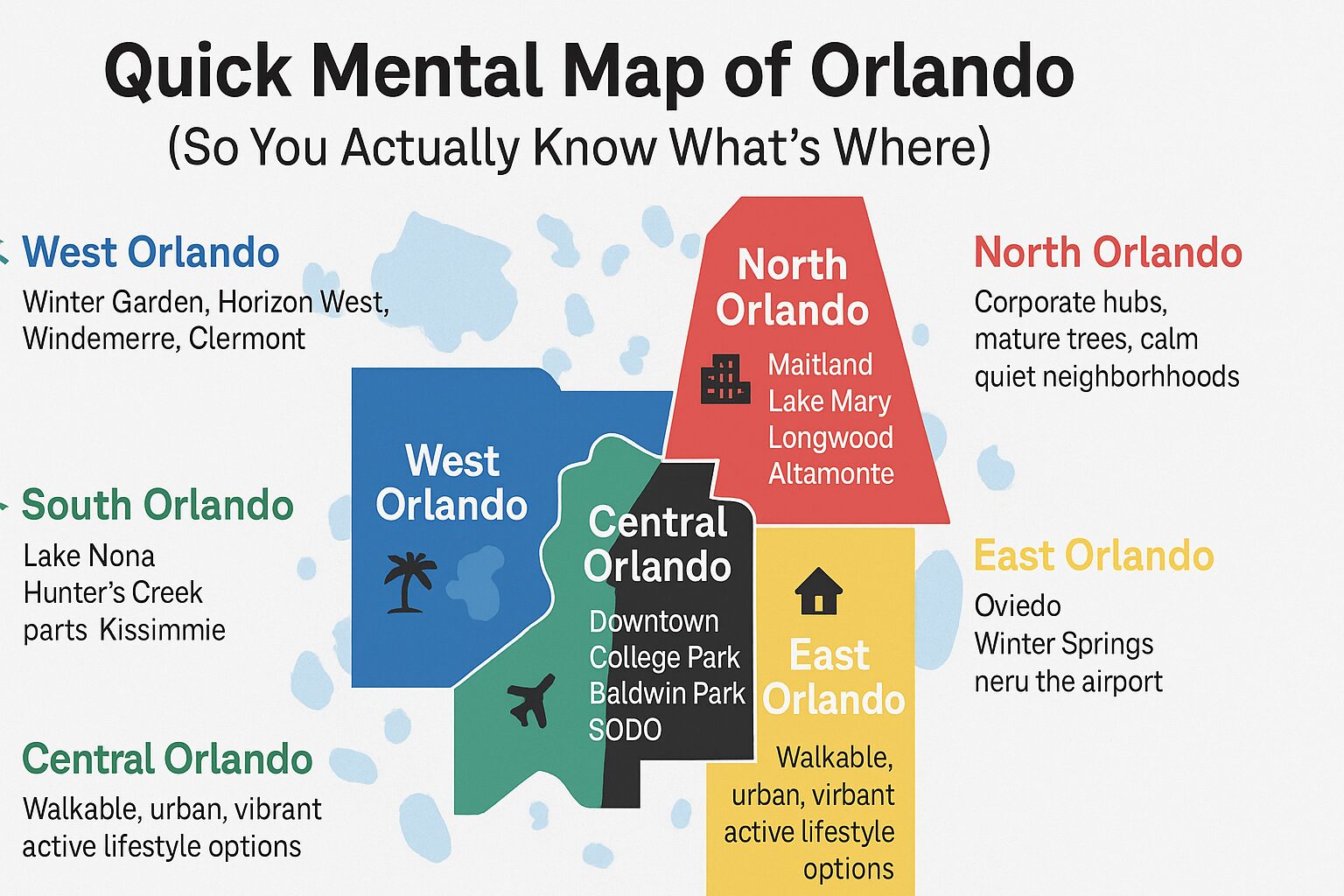

However, not all areas in Central Florida allow short-term rentals, and the market can be competitive. A good understanding of local trends, property values, and the types of rental properties that perform best will help you make informed decisions. Properties with easy access to major attractions, such as those in Kissimmee, Davenport, and parts of Orlando, tend to fare better as short-term rentals.

2. Know the Local Laws and Regulations

Before buying an investment property for short-term rental in Central Florida, familiarize yourself with state and local laws that regulate vacation rentals. In Florida, short-term rentals are generally considered stays of less than 30 days. However, regulations can differ significantly between counties and even neighborhoods.

- County Ordinances: Each county has its own rules for short-term rentals. For example, Orange County (home to Orlando) has specific zones where short-term rentals are permitted. Failure to comply with local ordinances could result in hefty fines, so it’s crucial to confirm whether your intended property lies within a permissible area.

- Licensing Requirements: Operating a short-term rental in Florida generally requires a state business license as well as a local tourist development tax account. Be prepared to obtain the proper permits before you start hosting.

- Taxes: In addition to income tax, you’ll need to pay local taxes on your rental income. This includes sales tax, and in some areas, a tourist development tax.

3. HOA and Community Restrictions

One major hurdle when buying a short-term rental property is the presence of Homeowner Associations (HOAs). HOAs are common in Florida, and they often have strict rules about short-term rentals.

- Rental Duration Limits: Some HOAs allow rentals, but only for longer terms (typically six months or more), effectively ruling out the short-term rental market.

- Approval Requirements: Other HOAs require property owners to get approval before renting, which may add time and hassle to your investment plans. Ensure you thoroughly review the HOA’s Covenants, Conditions, and Restrictions (CC&Rs) before purchasing.

- Community Vibe: Even if allowed, a community that has a negative stance on vacation rentals may make it challenging to manage your property successfully, as complaints from neighbors can lead to difficulties with HOA boards.

4. Finding the Right Location for Investment

Location is a critical component of success when buying a short-term investment property in Central Florida. Areas closer to major attractions tend to have higher occupancy rates, but these locations also come with higher property prices.

- Kissimmee and Davenport: These towns are well-known for their proximity to Disney World and have many communities that cater to vacation rentals. They offer numerous amenities that appeal to tourists and tend to have lenient rental regulations.

- Orlando: Certain neighborhoods in Orlando, particularly those further from downtown, are attractive to vacation renters. Look for areas with good transportation access to theme parks and other local attractions.

- Lakeland and Clermont: These towns offer a more affordable entry into the short-term rental market while still being a manageable drive away from Central Florida’s popular attractions.

5. Financing Your Short-Term Rental Purchase

Financing an investment property, especially for short-term rental purposes, can be different from buying a primary residence.

- Higher Down Payments: Lenders often require higher down payments (20% or more) for investment properties compared to primary residences.

- Interest Rates: Interest rates on mortgages for investment properties also tend to be higher.

- Consider Vacation Rental Loans: Some lenders specialize in loans for vacation rentals and may offer terms tailored for buyers looking to make income through platforms like Airbnb or VRBO.

6. Calculate the Costs and Potential Return

Buying a second home for short-term rentals comes with different financial dynamics compared to buying a primary home or long-term rental property.

- Operating Costs: Include maintenance, property management fees (if you won’t be managing it yourself), utilities, and furnishing costs. Short-term rentals often require a higher standard of furnishing and decor to attract renters.

- Insurance: Standard homeowners insurance may not be sufficient. Vacation rental properties often require specific insurance that covers liabilities related to short-term tenants.

- Vacation Rental Platforms: Listings on popular platforms such as Airbnb and VRBO often charge service fees that can eat into your profits, so it’s important to account for this as well.

- Expected Rental Income: Research the average occupancy rate and nightly rental price for similar properties in the area. A higher occupancy rate can help balance out the higher costs associated with short-term rentals.

7. Property Management Considerations

Managing a short-term rental property in Central Florida requires more effort than a traditional long-term rental.

- Self-Management vs. Hiring a Manager: If you’re not local or don’t want to deal with guest communication, cleaning, and maintenance, you may want to hire a property management company. These companies typically charge between 10% and 30% of your rental income.

- Guest Services: Today’s guests expect quick responses, clean homes, and well-stocked amenities. Using a property manager or automation tools can help streamline this process.

8. Navigating Zoning Laws and Regulations

Zoning laws may also affect your ability to rent out your property on a short-term basis. Some municipalities have restrictions against short-term rentals in residential zones.

- City Zoning: For example, Orlando has specific zoning laws, and in some parts of the city, short-term rentals are only allowed in properties where the owner also resides on the premises.

- Neighbor Relations: Even if a property is zoned correctly, neighbors may oppose having a revolving door of renters nearby. Maintaining good relationships with neighbors can go a long way toward ensuring your rental operates smoothly.

9. Key Considerations Before Purchasing

Before making your decision, keep these key points in mind:

- Check Occupancy Rates: Use tools like AirDNA to research the average occupancy rates and nightly rental rates in the areas you’re considering.

- Review HOA Regulations: Avoid surprises by obtaining and reviewing HOA documents before you buy.

- Calculate Cash Flow: Factor in mortgage payments, maintenance, taxes, insurance, platform fees, and management fees. Ensure your expected rental income will cover all of these costs and still generate a positive cash flow.

- Long-Term Prospects: Keep an eye on property appreciation. Central Florida’s housing market has been appreciating in recent years, making it an attractive place for buying a second home for short-term rentals.

Conclusion: Is Buying a Short-Term Investment Property in Central Florida Right for You?

Investing in a short-term rental property in Central Florida can be highly profitable if you understand the local regulations, find the right property, and plan accordingly. From navigating county ordinances and HOA restrictions to calculating your potential cash flow, every detail plays a role in your success. The Sunshine State’s allure will always draw tourists, and with the right approach, your investment property could provide significant income and long-term appreciation.

For those looking to capitalize on the booming vacation rental market, Central Florida offers an exciting opportunity. Whether you’re buying a second home for short-term rentals or seeking your first investment property, taking the time to understand the complexities will give you the best chance for success.

Ready to dive into the Central Florida short-term rental market? The Erica Diaz Team has extensive experience in finding investment properties and understanding where short-term rentals are permitted. We can guide you through the process of finding the perfect property, navigating regulations, and ensuring your investment pays off. Contact the Erica Diaz Team today at (407) 951-9742 for a free consultation, and let our expertise help you make informed decisions on your investment journey.

Counties and Areas in Central Florida Where Short-Term Rentals Are Allowed

- Osceola County: Including areas such as Kissimmee and parts of Davenport, which are highly popular for vacation rentals.

- Lake County: Areas like Clermont and parts of Groveland allow for short-term rentals, offering proximity to the attractions while being more affordable.

- Polk County: Davenport and Haines City are common places where short-term rentals are welcomed.

- Orange County: Specific zones in Orlando allow short-term rentals; always confirm the zoning regulations before purchasing.

Thinking of investing in a short-term rental in Davenport or beyond? Let an experienced Davenport real estate agent help you find the right property, understand the local rules, and maximize your rental income potential. Contact the Erica Diaz Team today to get expert guidance every step of the way. Your next profitable investment starts here.