Thinking of Retirement?

As retirement approaches, the need for a robust and reliable retirement plan becomes increasingly crucial. While traditional options like pensions and 401(k) plans have their benefits, investing in real estate has emerged as one of the most advantageous and promising strategies for securing a comfortable retirement. In this blog, we will delve into the reasons why investment properties stand out as the best retirement plan, offering stability, passive income, tax advantages, and potential for long-term growth.

Diversification and Stability

One of the fundamental principles of sound financial planning is diversification. Real estate investments provide an excellent opportunity to diversify your retirement portfolio beyond stocks and bonds. Unlike the volatile nature of the stock market, property values tend to be more stable over time. While property prices may fluctuate in the short term, historically, real estate has shown steady appreciation, providing a reliable source of wealth accumulation for retirement.

Passive Income Stream

One of the most significant advantages of investing in rental properties is the potential for a passive income stream during retirement. Owning rental properties allows you to collect rental income from tenants, which can supplement other sources of retirement income. With careful property selection and effective property management, you can create a consistent cash flow that covers living expenses and provides financial security well into your retirement years.

Inflation Hedge

Inflation can erode the purchasing power of your savings over time, affecting the value of your retirement funds. However, real estate is considered a natural hedge against inflation. As prices rise, so do rental incomes and property values. This means that your investment properties can keep up with or even outpace inflation, protecting your wealth and ensuring a stable financial future.

Leverage for Greater Returns

Real estate investments offer unique advantages, including the ability to use leverage. When you purchase a property using a mortgage, you are leveraging the bank’s money to increase your potential returns. As the property appreciates, the return on your initial investment can be amplified, leading to greater long-term wealth accumulation. Careful analysis and responsible borrowing can help maximize these benefits.

Tax Advantages

Investment properties offer various tax benefits that can significantly enhance your retirement savings. The most notable tax advantage is the ability to deduct expenses related to property ownership, including mortgage interest, property taxes, insurance, maintenance costs, and more. Depreciation is another powerful tax benefit for rental property owners, allowing you to write off a portion of the property’s value each year.

Equity Buildup

As you pay down the mortgage on your investment property, your equity in the property increases. Building equity over time is like saving money, but with the added benefit of potential property appreciation. This equity can serve as a financial safety net during retirement, providing additional financial security.

Retirement Diversification

A retirement plan based solely on stocks and bonds can be risky, especially during times of market volatility. By incorporating investment properties into your retirement plan, you add another layer of diversification. Real estate values tend to be less correlated with stock market movements, meaning that when one asset class performs poorly, the other may excel, balancing out your overall portfolio.

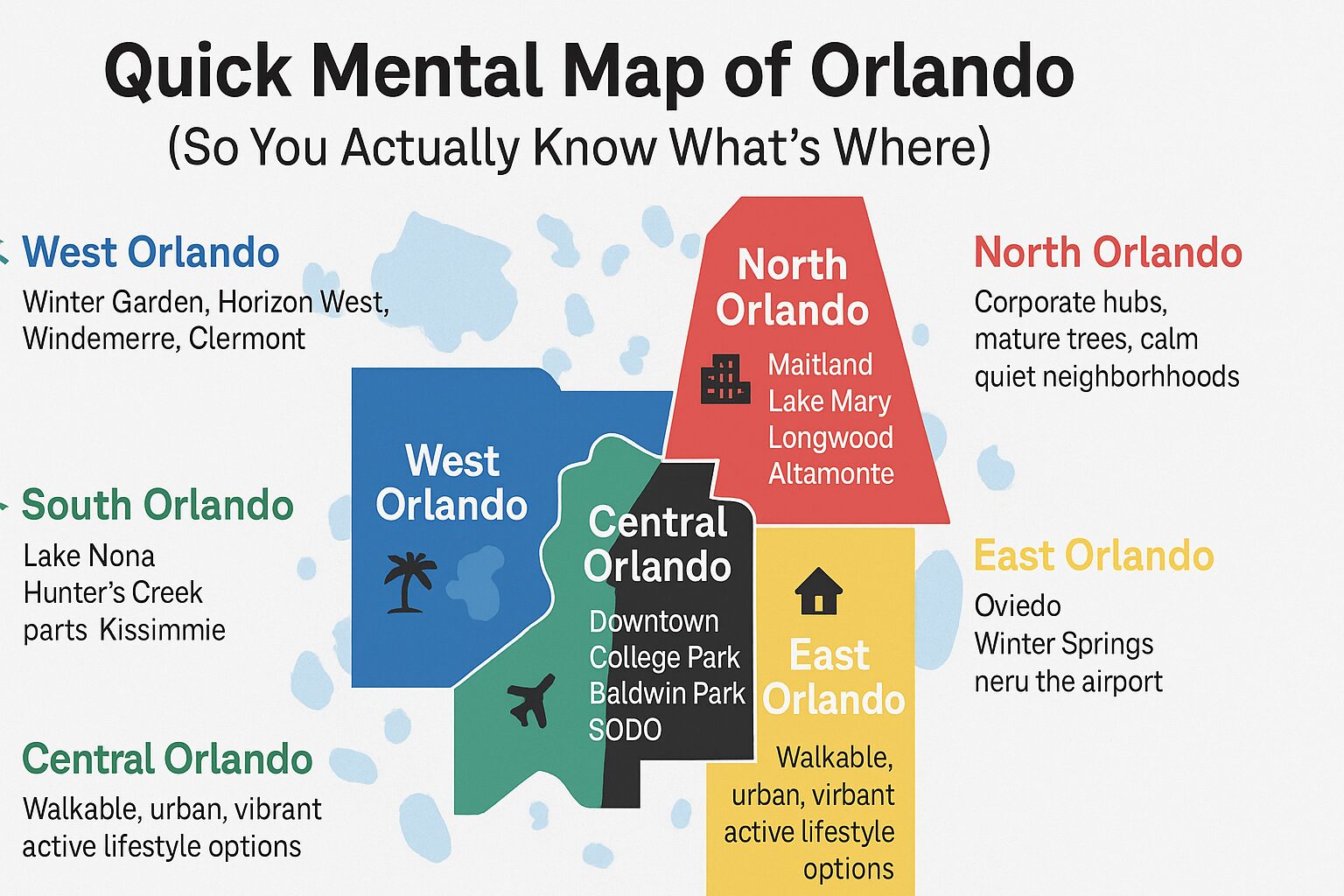

Retirement Location Flexibility

Investment properties offer retirees the flexibility to choose their retirement location. As you invest in properties, you can strategically acquire assets in areas where you would like to retire. Whether it’s a beachfront condo, a rural farmhouse, or a city apartment, you can tailor your real estate portfolio to match your ideal retirement lifestyle.

Conclusion

Conclusion

Investment properties present a compelling case as the best retirement plan due to their ability to provide diversification, passive income, stability, tax advantages, and potential for long-term growth. As you plan for your retirement, consider incorporating real estate into your portfolio to enjoy the benefits of property ownership and secure a comfortable and financially stable future. However, it is essential to approach real estate investing with proper research and due diligence to make informed decisions and reap the full rewards of this strategy. Always consult with a professional realtor and financial advisor to align your investment decisions with your specific retirement goals and risk tolerance. Ready to buy your investment property? Give us a call, we can help!