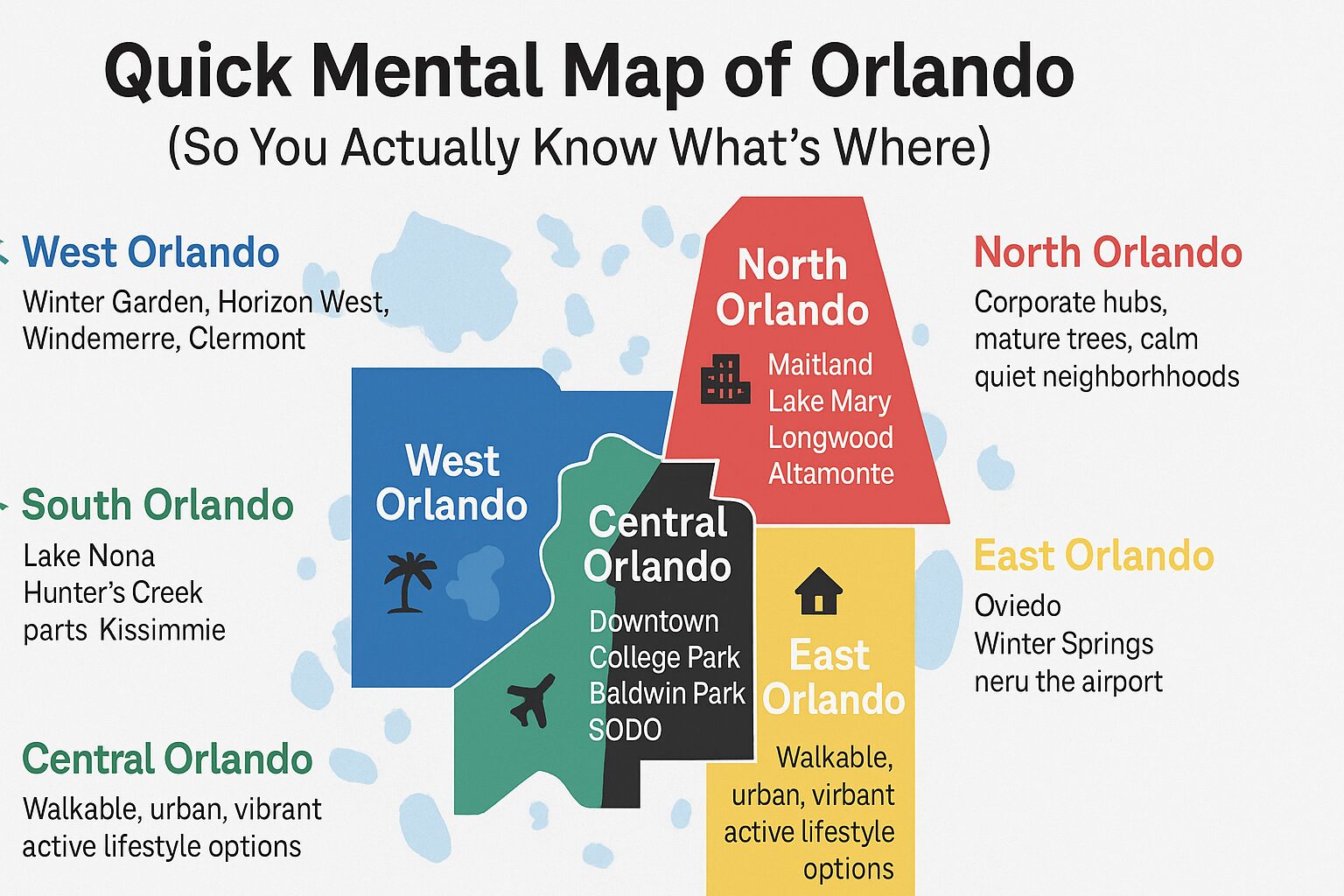

Are you a homeowner in Central Florida? If your home is your primary residence, you could be eligible for the Florida Homestead Tax Exemption, saving you up to $750 per year in property taxes.

Whether you already live in the area or plan to move to cities like Winter Garden, this guide—brought to you by the Erica Diaz Team—explains everything you need to know about the 2025 Homestead Tax Exemption.

If you do not currently reside in Central Florida, maybe moving here is on your radar in the future. Or maybe you do live here and are considering buying a new home in Winter Garden or another Central Florida city. If either of these describes you, the Erica Diaz Team would love to connect with you and show you the area. Contact the team today!

What is the Homestead Tax Exemption?

Florida’s Homestead Tax Exemption allows eligible homeowners to reduce the taxable value of their primary residence by up to $50,000. This results in hundreds of dollars saved on your annual property taxes. Additionally, once granted, your home’s assessed value can’t increase more than 3% per year due to the Save Our Homes cap.

?2025 Filing Deadline

You must apply by March 1, 2025 to receive the exemption for this year. If you miss the deadline, you can apply again starting January 1, 2026.

? Good to know: Once granted, your exemption automatically renews each year—unless there’s a change in ownership or residence.

Eligibility Requirements (as of January 1, 2025)

To qualify, you must:

- Be a U.S. citizen or lawful permanent resident (Green Card holder)

- Use the home as your permanent, full-time residence

- Have legal or equitable title to the property (recorded in county records)

- Reside in Florida as your primary place of residence

How to File by County (2025)

You can file online, by mail, or by phone. Online filing is recommended:

Orange County

- Website: Orange County Property Appraiser

- Phone: (407) 836-5044

- Mailing address: Orange County Property Appraiser

- Attention: Exemptions

- 200 S. Orange Avenue, Suite 1700

- Orlando, FL 32801

Lake County

- Website: Lake County Property Appraiser

- Follow instructions to complete your application online or download it.

What You’ll Need to Apply

- Florida driver’s license or ID card

- Social Security numbers (for all owners and spouses)

- At least one of the following:

- Florida vehicle registration

- Florida voter ID card

- Recorded Declaration of Domicile

- Permanent Resident Card (if applicable)

What If You Move in 2025?

If you move to a new primary residence, your existing exemption ends. You’ll need to:

- Apply for a new Homestead Exemption on the new property

- Meet the same eligibility and file again between Jan 1 – Mar 1, 2026

Portability & Save Our Homes Explained

Portability allows you to transfer up to $500,000 of your property tax savings from your previous homestead to your new one. You must apply for this within 2 years of selling your prior home.

Save Our Homes (SOH) limits annual increases in your home’s assessed value to 3% or the Consumer Price Index, whichever is lower.

Final Thoughts

The Florida Homestead Tax Exemption is one of the best property tax breaks available to homeowners. It’s simple to apply for and can save you hundreds each year.

Don’t wait—apply before March 1, 2025 to lock in your savings!

? Thinking of buying a home in Central Florida?

Contact the Erica Diaz Team to find your perfect home and get expert guidance on your Homestead Exemption and more.