Buying or selling a home is exciting, especially if you’re starting fresh or moving into your dream property. But if it’s your first time, the process can also feel overwhelming. One of the biggest question marks? Closing costs.

Let’s clear it up. When you understand what closing costs are and how much to expect, the entire experience becomes a lot less stressful.

What Are Closing Costs?

Closing costs are the fees and expenses due at the end of a real estate transaction. This is when the ownership of the home officially changes hands from the seller to the buyer.

Both buyers and sellers have closing costs, although the specific fees and who pays what can vary.

How Much Are Closing Costs?

For buyers, closing costs usually fall between 2% and 5% of the purchase price. On a $300,000 home, that means you could pay anywhere from $6,000 to $15,000.

According to a recent survey, the average buyer pays about $3,700 in closing fees. Your exact number will depend on your lender, location, and loan type.

What Is a Loan Estimate?

After applying for a mortgage, your lender will provide a Loan Estimate within three business days. This form outlines your estimated interest rate, monthly payments, and closing costs.

It’s just an estimate, and some costs may change. However, many of these fees are negotiable. That’s why it’s smart to compare lenders and ask about fee reductions upfront.

What Is a Closing Disclosure?

You’ll receive a Closing Disclosure at least three business days before your closing date. This form shows your finalized loan terms and all closing costs.

It’s important to compare the Closing Disclosure to your original Loan Estimate. Ask your lender about any changes and make sure you understand each line item. Regulations limit how much certain fees can increase, so if something seems off, speak up. You still have the option to walk away before signing.

Common Closing Costs You Might See

Not all closings involve the same fees. They depend on your location, your loan, and the home you’re buying. Below is a breakdown of common closing costs, though your transaction may not include every item.

Lender and Loan Fees

- Application Fee: Covers your loan application processing, sometimes including a credit check

- Origination Fee: Lender’s administrative cost, often around 1% of the loan amount

- Underwriting Fee: Charged by the lender to evaluate your loan approval

- Loan Discount Points: Optional payment to lower your loan’s interest rate

Property-Related Services

- Appraisal Fee: Required to confirm the home’s market value

- Home Inspection: Evaluates the condition of the home and identifies any issues

- Survey Fee: Verifies property lines, sometimes required depending on location

- Pest Inspection: Often needed for government-backed loans

Insurance and Escrow

- Homeowners Insurance: Usually paid upfront for the first year

- Private Mortgage Insurance (PMI): Required if your down payment is under 20%

- Flood Determination Fee: Confirms whether flood insurance is needed

- Escrow Deposits: Prepaid funds for taxes and insurance

Title and Legal Fees

- Title Search: Verifies ownership and checks for any legal issues

- Title Insurance: Protects the buyer and lender in case of ownership disputes

- Attorney Fees: May apply in states where a lawyer is required at closing

- Recording Fees: Paid to the city or county to update public records

- Transfer Taxes: Charged when the title is transferred to the new owner

Government or Loan-Specific Fees

- FHA Upfront Mortgage Insurance: One-time fee for FHA loans, typically 1.75% of the loan

- VA Funding Fee: Applies to VA loans, based on service history and down payment

Optional or Situational Costs

- HOA Transfer Fee: Covers transfer of ownership within a homeowners association

- Lead-Based Paint Inspection: Recommended for older homes

- Courier Fee: For delivering documents quickly

- Credit Report Fee: Required to evaluate your credit for the loan

Can You Avoid Paying Closing Costs?

There are loan options that advertise “no closing costs,” but that doesn’t mean the fees disappear. Lenders might add them to your total loan balance or increase your interest rate. Either way, you’ll still be paying them over time.

Another option is to negotiate with the seller. In competitive markets or with the right offer, the seller may agree to cover some or all of your closing costs.

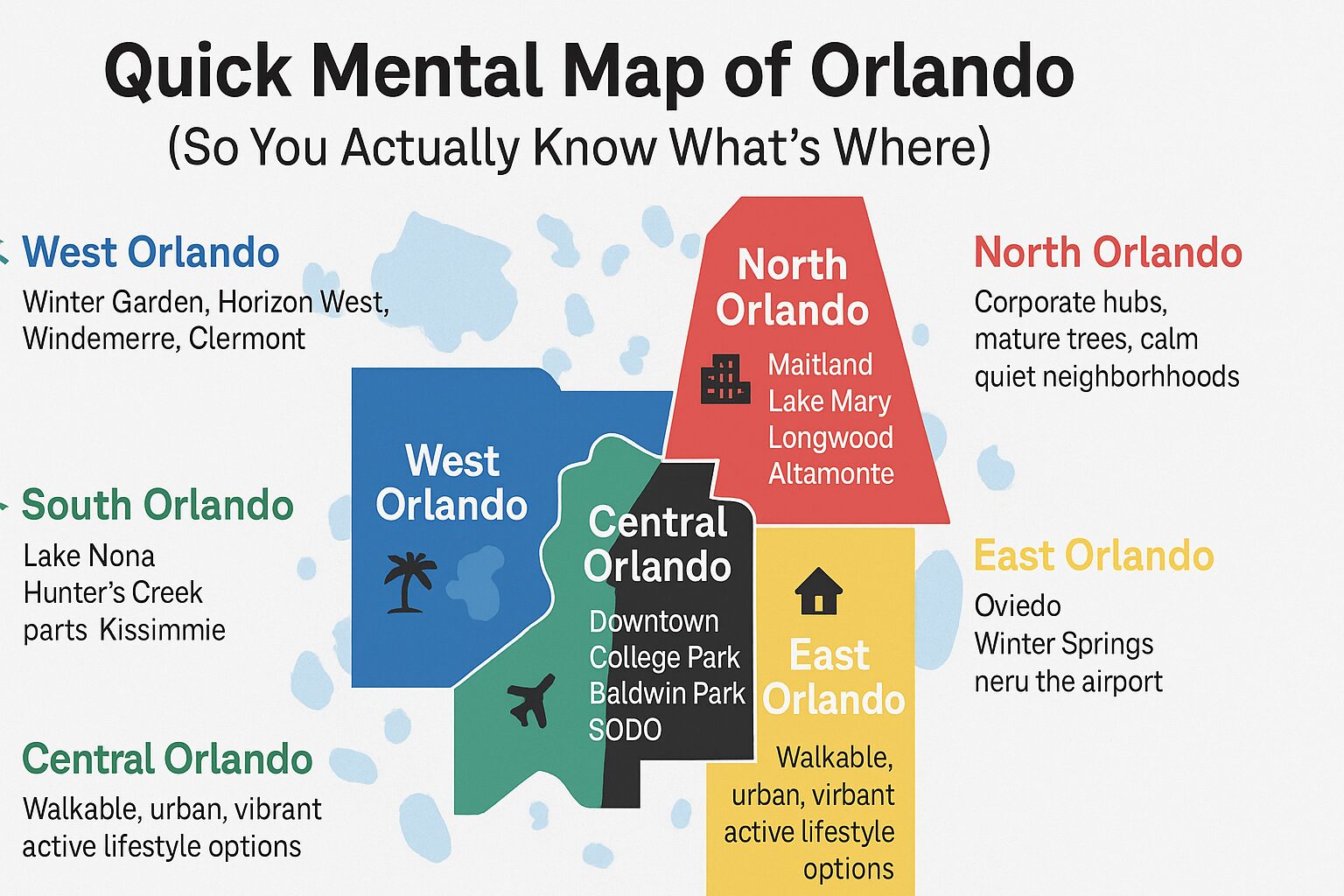

Final Thoughts from the Erica Diaz Team

Understanding your closing costs helps you prepare for one of the biggest investments of your life. Whether you’re working with a mortgage lender or a trusted real estate agent, knowing the breakdown of these fees can help you make smart decisions. When you know what to expect, the process feels a lot more manageable and you can make smart, confident decisions.

If you’re looking to buy a home in Central Florida, we’re here to help. The Erica Diaz Team will guide you through every step, from finding the perfect property to sitting at the closing table.

Reach out today and let’s start the journey to your new home.